15+ Figure mortgage

Choose from 30-year fixed 15-year fixed and 5-year ARM loan scenarios in the calculator to see examples of how different loan terms mean different monthly payments. 49 rows Here are some of the advantages of a 15-year mortgage over a 30-year mortgage.

Loan Schedule 15 Examples Format Pdf Examples

Our loan amounts range from a.

:max_bytes(150000):strip_icc()/PREAPPROVEDMORTGAGEJPEG-e4fb5ba8d0164c7699b4b376a1492293.jpg)

. For example if you saved a 50000 deposit for a. Borrowers can choose home equity loan terms of five 10 15 or 30. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage.

A 15-year mortgage is designed to be paid off over 15 years. Make sure to add taxes insurance and home maintenance to determine if you can afford the house. Going back to our example 300000 mortgage and assuming that you can put 2000 toward your mortgage each month the 30-year fixed rate mortgage at 4625 would.

The interest rate is lower on a 15-year mortgage and because the. Lenders define it as the money borrowed to pay for real estate. Figures Home Equity Line and Mortgage products require that you pledge your home as collateral and you could lose your home if you fail to repay.

How to calculate your mortgage payments. A mortgage is a loan secured by property usually real estate property. Loans of other durations far less common.

The average interest rate for a 15-year mortgage is currently 523 compared to the 30-year mortgage rate of 603. The 15 year loan will cost you 487 more monthly and save you 100188 in total interest compared to the 30 year loan. Whats the monthly payment of a 150000 loan.

The 15-year is the next most popular fixed-rate loan with a 134 share of the market. The minimum home equity line of credit is 15000 or 25001 in Alaska and the maximum is 400000. FRMs are a one-way bet for consumers.

Mortgage finance calculators home interest. It can be used for any type of loan like a car home motorcycle boat business. While both loan types have similar interest rate profiles the 15-year loan.

165000 at 102 for. If interest rates rise. Use this calculator to find the monthly payment of a loan.

On a 30-year jumbo. Calculate Mortgage Payment 15 Year Fixed - If you are looking for options for lower your payments then we can provide you with solutions. A 30-year mortgage is structured to be paid in full in 30 years.

If you have some room in your budget a 15-year fixed-rate mortgage reduces the total interest youll pay but your monthly payment will be higher. In essence the lender helps the buyer pay the seller of a. 165000 at 101 for 15 years.

This type of 15-year.

Mct Trading Com Mcttrading Twitter

How Much Will Cecl Impact Reserves For First Mortgage Portfolios

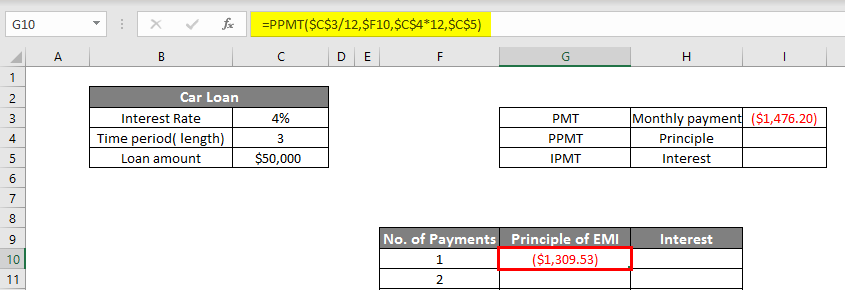

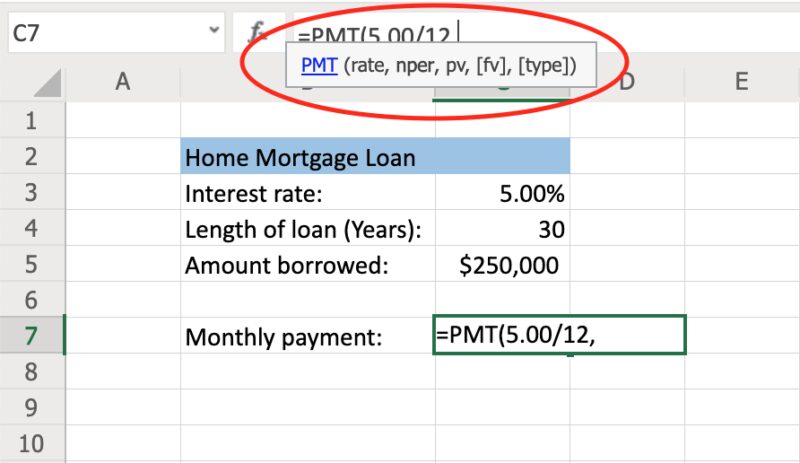

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

The Loan Officer Podcast

How To Calculate Monthly Loan Payments In Excel Investinganswers

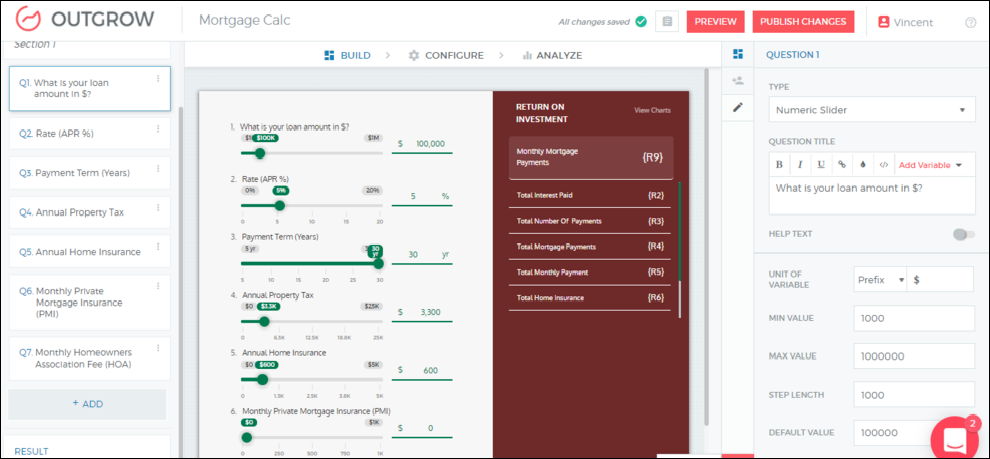

How To Build A Mortgage Calculator Interactive Calculator Outgrow

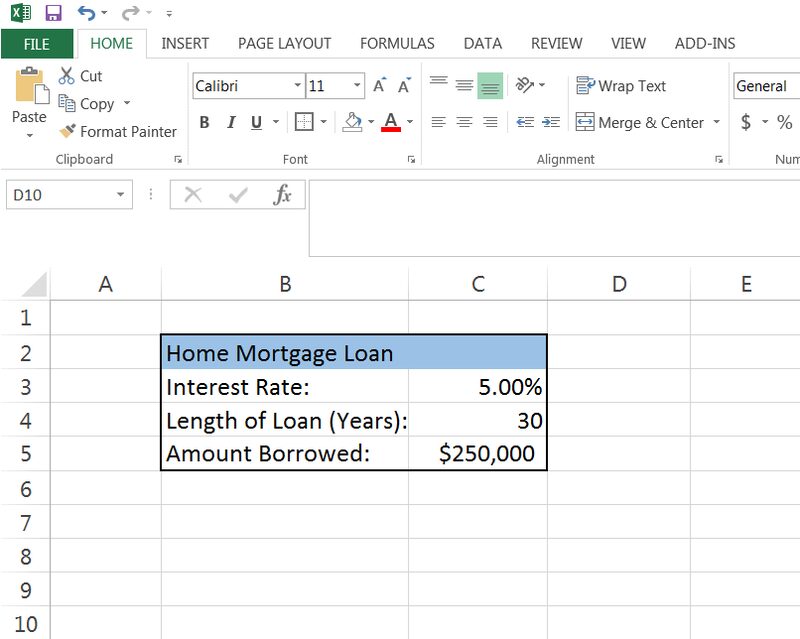

How To Calculate A Mortgage Payment In Excel Excel Explained

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

How To Calculate Monthly Loan Payments In Excel Investinganswers

Investment Property And Rental Property Loans Summit Credit Union

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Home Mortgage Calculator Templates 13 Free Docs Xlsx Pdf Mortgage Amortization Calculator Line Of Credit Mortgage Calculator

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

:max_bytes(150000):strip_icc()/mortgage-preapproval-4776405_final2-f5fbd4d3d08d4aeeb04cc12fc718ae00.png)

How To Get Pre Approved For A Mortgage

:max_bytes(150000):strip_icc()/average-what-can-i-expect-my-private-mortgage-insurance-pmi-rate-be.asp-d107c689ce61440b9ccc69363bbc08c0.png)

On Average What Can I Expect My Private Mortgage Insurance Pmi Rate To Be

:max_bytes(150000):strip_icc()/PREAPPROVEDMORTGAGEJPEG-e4fb5ba8d0164c7699b4b376a1492293.jpg)

How To Get Pre Approved For A Mortgage

Excel Mortgage Calculator How To Calculate Loan Payments In Excel