37+ First home buyer borrowing calculator

Lets look at a couple of basics. Capital Gains Tax Calculator.

Handy Home Blog Calculating How Much You Can Afford To Spend On A Mortgage Payment Buying First Home Home Buying Tips Buying Your First Home

If you live in an area where real estate values are high purchasing a home may be unattainable as a first-time buyer on an entry-level salary.

. Real estate appreciation in the United States during 2018 and 2019 ran at 51 and 42. Often the answer to the question Should I buy a home or a car first is out of necessity its easier and faster to save the down payment on a 20000 purchase than a 200000 one so. 9 For the Home Owners Dream 3 year fixed where the borrower pays an upfront fee of 697 then a corresponding loyalty discount of 020 pa.

Looking at new commitments 7181 were for home purchases while 2359 were for remortgages. Whether youre a first-time buyer upgrader or investor find advice you can trust. For example perhaps you bought a home for 500000 after closing costs and made a down payment of 100000.

Accessibility statement Accesskey 0 Skip to Content Accesskey S. 7 August at 928AM edited 19 August at 341PM in Food shopping groceries. Meanwhile new loan commitments for travel and holidays saw a slight uptick as did lending for household and personal goods.

First Home Buyer Loans. Use this free Texas Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest. Input your data into our calculator to compare your estimated payments for a home equity loan vs.

Home listing price was 449000 in July 2022 about the same as it was in June according to. 483 of people are shopping to buy their first homes while 189 of people are selling their current homes and buying a new one. Most respondents are first-time homebuyers.

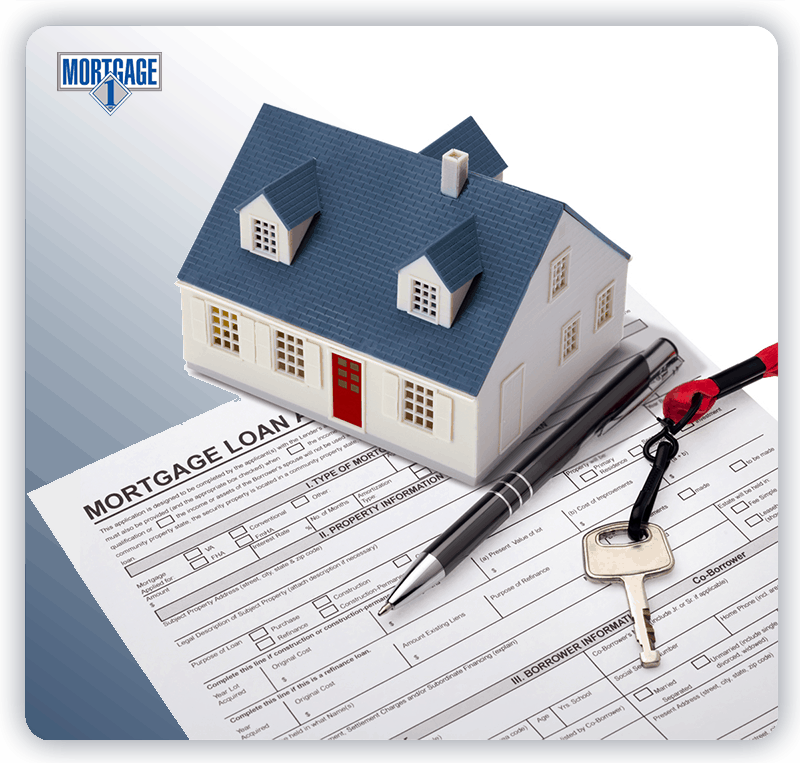

Think of a mortgage as a home loan. Loan Types Conventional Loans. If you are paying tax at the rate of 37 15 medicare levy you would receive a tax refund of 9625 per week.

Home prices are higher than theyve ever been and they show no signs of stopping. See how your monthly payment changes by making updates to. Get a rate hold and a certificate that your mortgage is pre-approved subject to conditions.

Home equity loans home equity lines of credit allow homeowners to borrow against a portion of their home equity while maintaining their first mortgage at its existing low rate. Credit Card Loans Eligibility Calculator. Choose from 37 portfolios conveniently on your OCBC Mobile Banking app.

A home equity loan is often referred to as a second mortgage and is taken out in one lump sum. Basically a mortgage is a loan used to buy a home. An affordable instalment loan for your one-time borrowing needs.

Soon youll be starting a new chapter of your life your Silver Years. Future advances and the other category round out the market at about 3 each. The mortgage calculator from Lloyds Bank can help you compare mortgages understand how much you could borrow and what your mortgage repayments would be.

Off the Home Owners Dream reverted variable rate at that time will automatically apply after the 5th anniversary of the loan. This calculator is designed to give property owners an estimate of the net income depreciation tax refund when owning an investment property in Australia. We often link to other websites but we cant be responsible for their content.

A HELOC is a line of credit you can draw funds from as needed similar to a credit card. Most consumers obtaining mortgages to purchase a home opt for the 30-year fixed-rate mortgage. So double check first.

And the home becomes the security for the mortgage loan. Its important to speak with the right person and understand how much mortgage you can afford based on term interest rate and principal amount. A way to get your feet on the property ladder - the first step on the way to getting out of renting or living with parents and getting a home of your own.

Another 224 of. Ready to take the next step. The figures also suggest first home buyers are not paying any less for the homes they are buying or borrowing less to finance the deals.

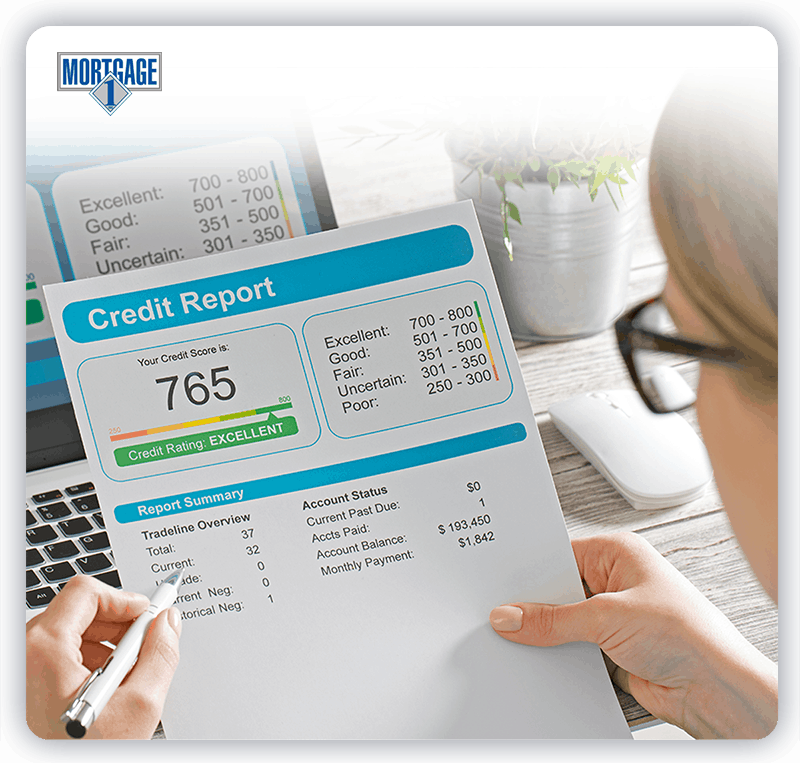

Pre-approval is an essential part of the homebuying process. In 2020 Fannie Mae anticipates home prices to increase 55 and increase a further 26 in 2022. This was largely driven by a 144 per cent decrease in lending for the purchase of road vehicles as well as a 371 per cent fall in lending for personal investment.

Try our Mortgage Repayment Calculator and see how much your monthly payments could cost with a market leading mortgage rate. Domain News - Provides the latest real estate and property market news in Australia. Shows which top cards and loans youre most likely to get.

Find out what forms of identification you can use when dealing with Lloyds Bank including passports National Identity Cards driving licences more. TransUnion published a study in 2017 which suggested there will be an average of 2 million HELOCs per year between 2018 and 2022. Interestconz estimates the average price paid for a home by first home buyers peaked at 761000 in May and then dropped back to 736000 in June which was still the fourth highest monthly average ever.

Get up to 6 times your. These fees and loyalty discount are factored into the comparison rate. However as a first-time homebuyer there are programs that can allow you to buy a home with a low income 0 down and credit scores as low as 500.

Javascript must be enabled for the correct page display private finance talk about a better mortgage. Breaking down the home purchase figures further 2332 were loans to first-time homebuyers 1115 were for buy-to-let mortgages and 3960 was classified as other. Mortgage Market Structure Purchase vs Refinance.

You will only need to borrow 400000 from a bank or mortgage lender in order to finance the purchase of the home. When looking at mortgages the mortgage principal is the amount of money that you owe and will need to pay back.

Fha Loan Pros And Cons Fha Loans Home Loans Buying First Home

97 Coffey Hill Rd Ware Ma 01082 Mls 73022354 Redfin

First Time Home Buyer Checklist First Time Home Buyers First Home Checklist Buying First Home

10 Steps Toward Home Ownership Mortgage 1 Inc

2001 2005 Coon Hill Rd Skaneateles Ny 13152 Mls S1361955 Zillow

How To Effectively Avoid These 5 Home Buying Mistakes Middleburg Real Estate Atoka Properties Buying First Home Home Buying First Time Home Buyers

10 Steps Toward Home Ownership Mortgage 1 Inc

10 Steps Toward Home Ownership Mortgage 1 Inc

10 Steps Toward Home Ownership Mortgage 1 Inc

How Much House Can I Afford Insider Tips And Home Affordability Calculator Home Buying Process Buying First Home Home Buying Tips

10 Steps Toward Home Ownership Mortgage 1 Inc

10 Steps Toward Home Ownership Mortgage 1 Inc

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information Fha Loans Refinancing Mortgage Mortgage Loans

Mortgage Tips And Tricks Assumption Assuming A Mortgage Home Mortgage Mortgage Tips First Time Home Buyers

First Time Home Buyer Vocabulary Cheat Sheet Buying First Home Home Buying First Time Home Buyers

10 Steps Toward Home Ownership Mortgage 1 Inc

Pros And Cons Of 15 Year Mortgages Buying First Home First Home Buyer Home Buying Tips